How the Government Will Take Your Cash

New rules introduced in July 2015 mean that savings of up to $1m may be protected for a six-month period if your savings provider goes bust.

The increase is to cover life events such as selling your home (though not a buy-to-let or second home), inheritances, redundancy, and insurance or compensation payouts that could lead to you having a temporarily-high savings balance.

The extra cover will apply from the date on which the money is transferred into the account, or the date on which the depositor becomes entitled to the amount, whichever is later. You'll need to prove where the funds came from in the event of a claim – and be prepared to wait up to three months for any cash over $75,000.

This change is a boon, because it allows you time to sort a plan for the cash. But, not only that, it also allows you to maximise savings by putting more cash into higher interest paying accounts than you'd otherwise be able .

Event Is Coming Soon – and as far as the IRS recouping thousands of dollars in unclaimed money, we DONE OWE THEM A DAMN DIME. They are only a corporation and it's illegal according to the Constitution. You owe the IRS absolutely NOTHING.

And the alternative to a system wide failure is the Barter System!

Of course they hacked the ATM machines right in the same summer of the year they are announcing a cashless society? They probably wrote the programs to attack the ATM's just so they can use this as a reason to get rid of cash. It's all the evil ones running this place, all of it is. You people better rise up NOW. Get your lazy asses up off the couch, put your remote down and start doing something.

State to attempt a massive ban on cash that would have resulted in making it illegal to use U.S. cash dollars in any secondhand transactions.

The law, called R.S. 37:1866, made it illegal to, say, go to a garage sale and buy a lawn mower with cash dollars. That’s right: It would have prohibited American citizens from using legal U.S. tender.

After an outcry by critics who called the law unconstitutional, Louisiana “amended” the bill to remove the widespread ban.

However, rather than end the ban completely, the state government chose instead to narrow the focus, making it illegal to exchange cash dollars for gold or any precious metals. This, of course, brings to mind the 1930s when FDR banned the private ownership of gold by U.S. citizens.

Via : breitbart.com

Banks can’t exist without deposits. Keeping money in a mattress is preferable to being financially bled to death with negative rates. Central bankers are well aware of this and are already prepositioning policies and taking steps to prevent the coming exodus. Outlawing large denominational physical cash and large cash transactions will be used to financially imprison the public while the negative interest rates simultaneously pick their pocket.

How low would negative rates have to go before you withdrew all of your money from the bank?

Laugh all you want. Pretend this is just another conspiracy theory run amok, but these policies are already set into motion in Europe with the U.S. trailing not very far behind. Under the guise of stopping criminal activity, ending corruption, and fighting the global war on terror, the last bastion of financial freedom is now being sacrificed to prop up a debt tsunami.

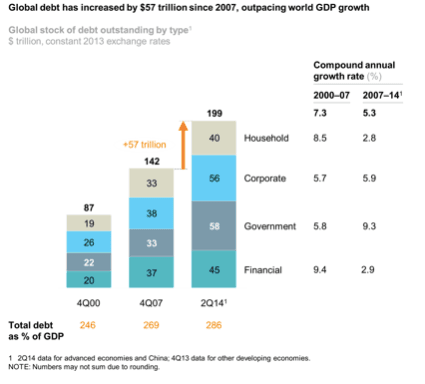

Global debt has increased by over 57 trillion dollars since 2007. At these levels, sovereign debt in particular cannot be repaid with sound currency. Rather than dealing with the debt and slowing its growth to levels below the rate inflation, the central bankers’ solution is to instead destroy physical cash and punish savers.

The cold reality is that just paying the annual interest cost, at historically normal interest rates of 3-4%, would be next to impossible for the majority of the world’s governments. Burdened with surging unfunded entitlement obligations, these governments no longer have any wiggle room for surgical reductions in spending. It is simply much easier for governments to reduce borrowing costs to below zero, eliminating those constraining interest payments, than admit they were wrong and reverse course.

Allowing politicians and central bankers to implement negative interest rates is like giving your teenage son a bottle of whiskey and the keys to the Ferrari─it will only lead to trouble. Arguments that the economy of the world is stable and improving does not match up with the over seven trillion dollars in mounting sovereign debt at negative interest rates that requires no interest payments.

The publicly stated reasons for eliminating cash are nothing but a red herring to fool the public into supporting this move and relinquishing their financial freedom without a fight. Criminality of all sorts will always exist with or without physical cash, but admitting to the world that the system itself will implode if ordinary people opt out of the banking system…that is what is really at stake.

Here are just some of the steps being taken to force the world into a cashless environment:

It is illegal to buy anything in France costing more than €1000 euros with physical cash. This number is down from €3000 euros just a few years ago.

Spain has banned cash transactions above €2,500 euros.

Italy banned cash transactions above €1000 euros.

Germany’s Deputy Finance Minister, Michael Meister, wants a €5,000 cap on cash transactions.

Former Treasury Secretary, Larry Summers, is calling for ending the $100 bill, and wants Europe to retire the €500 euro. This would effectively remove over 50% of all physical currency currently in circulation in Europe and the U.S.

The head of the European Central Bank, Mario Draghi, along with a growing list of former and current banking officials, is calling for ending the €500 euro.

Below is the breakdown of U.S. currency. The $100 bill represents over 78% of all physical currency in circulation. Much of these $100 dollar bills, along with large denominational euros, are used as storehouses of value in many third world countries. What happens when someone in say, Zimbabwe, goes to cash in their foreign U.S. dollars and is told that hundred dollar bills are no longer recognized?

Janet Yellen, Chairman of the Federal Reserve, has said she will not rule out negative interest rates here in the US. Canada is contemplating them too, if their economy continues to falter. The writing is on the wall that the trend is toward negative, rather than positive, rates across the globe. If we reach a point in the U.S. where the Fed feels it must implement negative rates, then the capital controls already in place will only expand, and the days of paying in cash will be numbered.

When civilization collapses, he predicts, the world will go back to barter. Urges everyone to have a disaster-preparedness kit containing enough food, water and other supplies to last 72 hours. This is sensible advice, and prepares have a point when they mock those who ignore it.

Europe and Japan have crossed the Rubicon into negative rates; the euro and yen are already both compromised as currencies. To surrender our cash will only endanger each and every American on a level no different than surrendering our right to free speech and self-defense. When a government is given the power to theoretically turn-off your access to cash with a flip of a switch, then we will no longer remain free, but instead become indentured servants to a failed state.

Click Here To See our Survival and Preparedness Solutions!

I have been hearing stuff like this since early 80's from newsletters and shortwave talk shows. Give us a timeline. I have emailed other fiancial sites and no reply, no one can give a timeline. King world news refuses to give out a time line along with several other online sites in last several months.

No timeline for America, but the time is NOW ( last week) in India. Prior to that is was Sweden.

Laura Ann, we don't need a timeline when you can already see it happening. They are already implementing negative interest rates in some countries, and it's being discussed here. They are slowly getting rid of cash so they can control what we do with our money and so that the negative interest rates can be implemented. It's a slow process so people will be more accepting of it as it's done incrementally. Unless something drastic happens, it could be anywhere from a year to maybe seven years before they try to abolish cash. We are being warned now so we have plenty of time to come up with a strategy and implement it, i.e. obtaining hard assets like land.